ElectricityRates.com

Powering Smarter Energy Choices

The browser you are using is not supported. Please consider using a modern browser.

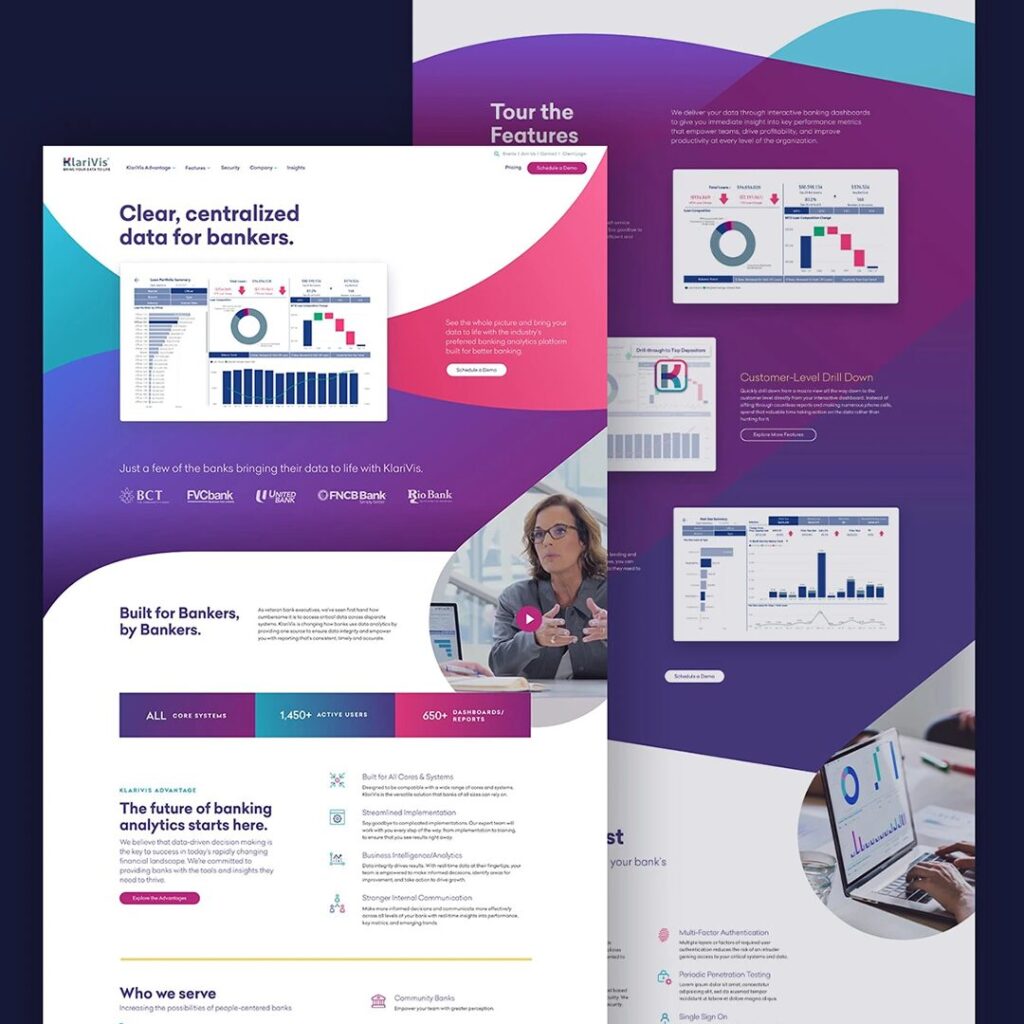

The banking analytics space was about to get crowded, and KlariVis knew it.

Founded in 2019, the company had spent its early years building and refining a sophisticated analytics platform for community banks. By 2023, revenue was growing, the team was expanding, and they realized they were building something powerful.

But the clock was ticking. The market was heating up, competitors were emerging, and KlariVis’s first-mover advantage had an expiration date. With a major industry event approaching, KlariVis had a perfect stage to reach hundreds of community banks seeking solutions exactly like theirs.

And they had a problem: their website looked exactly like what it was—a scrappy startup’s placeholder that didn’t reflect the sophistication of what the company had become.

“We had an incredible product, some great clients under our belt, and tremendous momentum,” recalls Erica Starr, KlariVis’s CMO. “We needed a partner that could very quickly elevate the sophistication of our look and feel and articulate what our product does and who it’s for.”

KlariVis solved a real problem. Community banks operate across multiple systems—loan origination, CRM, accounting, risk management—each generating its own reports. For executives trying to get a comprehensive view of performance, the current state meant pulling disparate reports and manually compiling data for hours before board meetings.

KlariVis connected all these systems and presented the data in real-time, customizable dashboards. A CFO could slice data one way, a lending officer another, all looking at the same centralized information.

As an emerging player in the FinTech space, KlariVis was competing on two fronts: 1) banks who believe the only way to get custom data analytics is with an in-house custom-built system, and 2) competing platforms that claim to do something similar, but in reality don’t even come close.

To win, the website needed to prove the incontrovertible value of the KlariVis platform without revealing proprietary features. Delivering on these goals required a tenuous balance of technical know-how, strategic creativity, and honest, open dialogue with stakeholders.

The timeline was aggressive: roughly three months from kickoff to the industry event. The strategy was a “fast track” soft launch of the site, with a plan to expand in phase two.

Even for the soft launch, there were some non-negotiables with content and functionality of the site.

The architecture had to accommodate different entry points and mindsets, from early adopters to cost-conscious skeptics. Vitamin worked with KlariVis to organize content around functional roles within a bank (executives, sales, credit, finance) and universal problem sets (decision-making, customer insights, efficiency, risk management).

For every visitor, the message needed to be clear: regardless of what systems a bank used or how fragmented their data was, KlariVis could seamlessly integrate with it all. Static screenshots were not enough, so Vitamin developed animations that showed real-time filtering and data visualization, all anonymized and secure, but tangibly demonstrating the platform’s dynamic nature in seconds.

That first industry conference was the proving ground, not just for the website, but for the KlariVis brand. Attendees who visited the KlariVis booth navigated to the website where they found a story that matched the sophistication of the in-person conversations. Later, KlariVis was able to expand on the site, adding more content to help qualify and educate buyers.

The banking analytics market did get more crowded, as anticipated. But KlariVis was already established and telling a story that positioned them as the leader.

“This was more than just a website project,” said Starr. “Vitamin was able to deliver a foundation of digital storytelling that continues to serve our brand years later.”